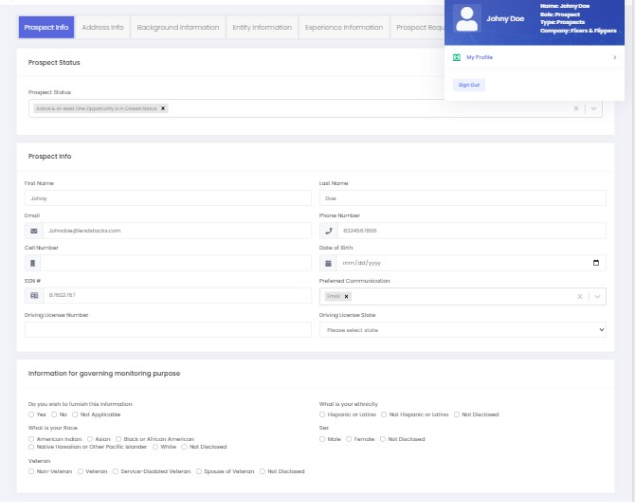

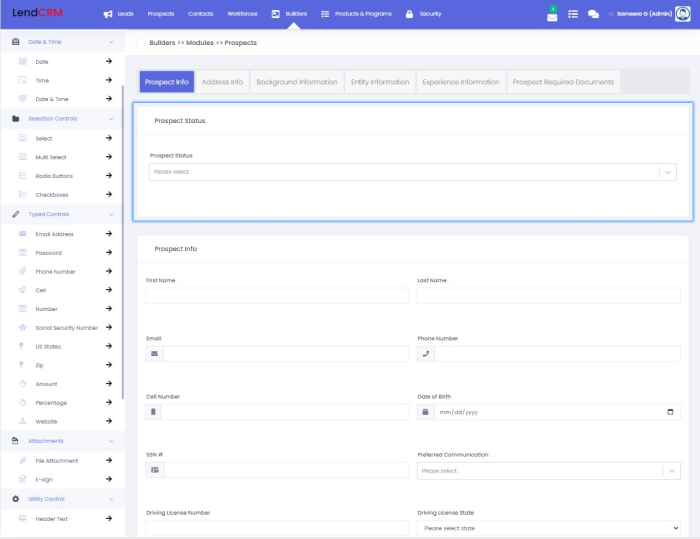

Borrowers

Using Our intuitive WYSIWYG Module Builder, You can Drag & Drop to create, update and delete fields on the fly to collect the required information & Documents on Borrowers, Guarantors. & Entities to Process, Under-Write, Close and Service your loans.

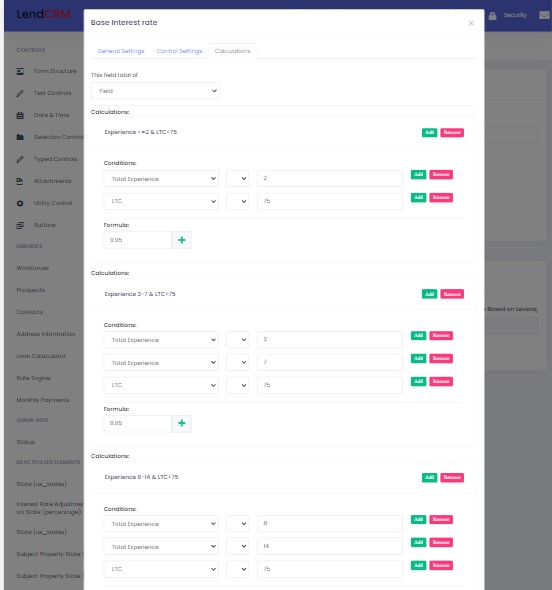

Loans

Our WYSIWYG Opportunity Builder will let you create and customize different loan programs to Process, Under-Write, Close and Service Loans.

Create Custom Modules to Create and Manage to manage your business process needs.